Big bucks. Old methods.

The market research industry is worth a tonne; 80 billion dollars in 2019 according to Esomar.

Companies in all industries and in every corner of the globe invest heavily in market research. Their collective MO might read:

“Let’s speak to people and find some stuff out”

Research should guide decision-making. It should inform. It should educate. It should motivate change and at times it should be provocative.

Pre-Internet almost all research implemented prompted and test-based primary research in order to collect data. Surveys, focus groups… that kind of thing.

Using these techniques, situations are controlled variables are manipulated and the outputs are recorded.

Quantitative and Qualitative

Survey based methods tend to get used when people want to ensure a degree of statistical robustness in their findings. Most often we sample some people who we think represent a population and then ask them some questions in a survey. The findings are then generalised to this population.

Surveys typically get filled in by 100’s, sometimes 1000’s of people. It is often impractical to speak to an entire population and on the very occasion that does happen (e.g a national census)– the investment in time and cost is huge. This is the main reason why we sample.

Survey based data is best suited answering the ‘what’, ‘where’ and ‘who’. It is also flawed.

-

The people that complete these surveys are invited to take part and are almost always incentivised.

-

They often are asked to answer emotional questions in a rational way

e.g. Please answer the following using this 5 point scale..(rational input)….To what extent is Nike a brand you can trust? (emotional output)

More ‘real’ methods such as focus groups and depth interviews are when we speak to fewer people and generally attempt to try and understand the ‘why’. Respondents often sit in a viewing facility answer questions posed by a moderator and are observed through a mirror by some enigmatic client quaffing complimentary booze.

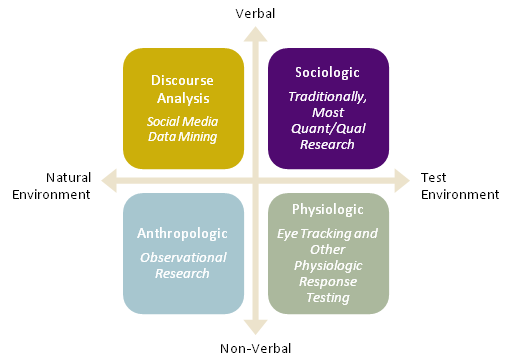

These test-based quantitative and qualitative methods have been used for decades. And whilst traditional primary research like this has some value… is it particularly scientific to only rely on data that is collected in a test situation?

This is where the power of observation becomes relevant in completing a more whole picture of what’s going on in the world.

The Bigger Picture

We have the Internet now. And with the vast volume of raw data freely available online – integrating online sources of data alongside traditional research approaches makes sense.

“But what data do we want to use?”

The questions you want to answer will influence where to go and find data.

If you’re exploring cultural trends then Twitter, blogs, forums and some news sites are relevant places to look. If you want to explore how people feel about services and products then looking at review sites might be more suitable.

TrustPilot

TrustPilot is one of the biggest review sites in the world. It consistently handles about one million new reviews a month covering all kinds of stuff from high street banks, to online florists and everything in-between. There is a plethora of unprompted, observable and free data on TrustPilot.

Not only this…but given that word of mouth and advocacy have consistently been proven to be as effective than advertising (if not more) then the need to integrate this kind of data alongside other inputs becomes even more relevant.

There is a strong case for a company to develop techniques to make use of this data and leverage it for commercial gain and this is what I intend to explore in this project using ASOS as a case study.

Project Aim

Implement an approach that allows ASOS to effectively extract and explore their data on TrustPilot in order to help them make smart and timely decisions in future.

If we can understand the relationship between what people say and how they rate ASOS, this will be useful.

This will align with business critical questions such as:

- How to improve ASOS’ service among people who are dissatisfied?

- What are ASOS doing right that they need to maintain and promote further?

- How can they implement this insight across other channels? What might that look like?

- Chat bots that can respond automatically and intelligently to customer feedback in real time

- Classification and organisation of other forms of communication e.g. customer feedback over email

Key Challenges and Strategy:

There are three stages to this project:

“How do we get the data?”

We will build a bespoke web scraping class in Python to extract ASOS TrustPilot reviews/data at scale. We will format the data to provide structure. EXTRACT the data.

“How can we distil the scraped data and convert it into useable information that will allow us to interpret and generate insights from?”

We will use Natural Language Processing techniques that will allow us to make sense of the data. We can look at what is being said (words) and how it is being said (meaning). EXPLORE the information.

“What can we do in terms of implementation that will enable us to act on this insight in a smart and timely manner?”

We will build AI that can predict if a review is likely to be rated positive or negative off the basis of what people say in their ASOS review. EXTRAPOLATE the insight

Click here to read the next part of the project..